Buna enables financial institutions and central banks in the Arab region and beyond to send and receive cross-border payments throughout the day at real-time in all available Arab and International currencies, serving as a single-entry point to the region’s financial systems for global financial institutions, as well as a multi-currency and multi-instrument system for local ones.

Buna introduces to the region a streamlined model to process cross-border payments, providing its participants and especially the commercial banks and other financial institutions with opportunities to expand their network in the region and beyond.

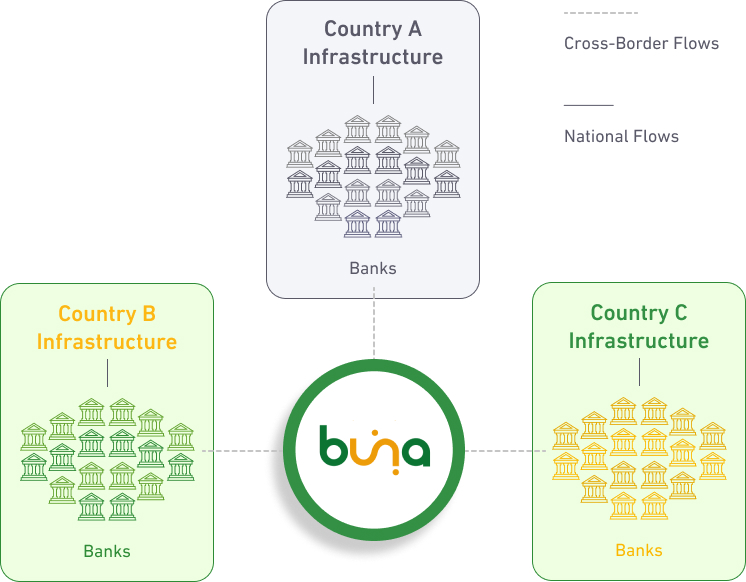

The diagram here illustrates Buna conceptually.

As a centralized cross-border and multi-currency payment system, that acts as a bridge between the Arab region and the rest of the world, Buna aims to:

By enabling payments processing in local currencies as well as key international currencies in a safe, cost-effective, risk-controlled, and transparent environment, Buna’s system design and operational approach embedded by construction the main directions of the “G20 roadmap” to enhance cross-border payments.

We strongly believe in the importance of joining forces and aligning visions to implement the “G20 roadmap” successfully and overcome the challenges of cross-border payments, and we will continue increasing our collaboration with all relevant authorities and stakeholders from around the globe to achieve that.

The goal of this roadmap to make cross-border payments faster, cheaper, more transparent, and more inclusive has been translated by Buna into the objective of “making cross border payment as efficient as domestic payment”. As a result, Buna is bringing tangible responses to each of the 19 building blocks and all the 5 focus areas of the “G20 roadmap”.